Seven Things That Are Really Going To Happen in 2025

As we ring out 2025, Bill Grosso offers predictions on game revenue monetization trends for 2025.

Every year around this time, you see the same two things happen. People make New Year’s Resolutions about how they will change their lives. And they make predictions about how the world will change. Oddly enough, both activities are often highly repetitive – “This year I will lose 20 pounds” is repeated almost as frequently as “This is the year that Applovin will buy Unity.”

Here at Game Data Pros, we’re not immune. We, too, have resolutions and predictions. But since we’re experts in Game Revenue Optimization (and not, for example, in game design or large-scale M&A), our industry predictions are focused entirely on game revenue.

If you want help leveraging any of these trends, or simply want to talk revenue optimization, please don’t hesitate to contact us.

Want more insights on game revenue optimization? Check out the Game Data Pros blog.

And now, without any further ado … here’s seven things that are really going to happen in 2025.

The Predictions, At a Glance

There Will be More Revenue

Mobile UA teams will continue to use MMMs for ROAS, and many teams will not experiment with or empirically validate their models

None of the “Top 100” mobile games that don’t already have a web storefront will implement one in 2025

Web Storefronts Will Achieve Significant Revenue Growth by Adopting Experimentation and Personalization

AR/VR will finally gain significant traction, making revenue optimization an even more difficult problem

Alternative App stores will be more than 10% of the Western mobile gaming market by install

It will become ordinary for games to sell physical goods and game-related merchandise in-game

There Will Be More Revenue

This is the most straightforward prediction and probably the least controversial: Sales will go up.

It’s easy to lose sight of the revenue numbers in the face of widespread industry problems. For example, 2024 was the third straight year of record layoffs in the video game industry. Matthew Ball shared a nice visual of the layoff trend on X.

But at the same time, industry revenue has never been higher and has never been healthier.

How healthy is it? At the recent AWS: Reinvent conference, Amazon estimated the digital entertainment market as follows:

Digital Entertainment in 2024. $1 Trillion in consumer spending.

Gaming in 2024. At least 25% of that.

Digital Entertainment in 2028. $3.8 trillion in consumer spending.

Gaming in 2028. At least 25% of that.

Restating that: Amazon forecasts that gaming will be a $800 billion industry in 2028.

Mobile UA teams will continue to use MMMs for ROAS, and many teams will not experiment with or empirically validate their models

A strange thing happened in gaming between 1990 and 2020. Marketing precision first improved dramatically and then regressed almost as dramatically.

In 1990, marketers bought ads and knew they worked, but they didn’t have a good idea of which ads worked or how effective a particular ad was. John Wanamaker, a famous merchant from the 1800’s, once described this way of advertising with the quip “Half the money I spend on advertising is wasted; the trouble is, I don’t know which half.”

As advertising became digital and performance marketing gained traction, that changed. This was especially true in mobile gaming—in 2017, by using IDFAs and other forms of deterministic attribution, you could start to precisely measure which ads a user saw and attribute installs to ads (it wasn’t perfect, but it was good. Possibly very good).

And then IDFA deprecation happened and … well … umm … Tim Sweeney put it best:

Marketers reacted quickly by resuming their use of observational causal inference models to measure advertising effectiveness.

Unfortunately, however, the problem of misinformation originating from observational causal inference in business analytics is serious.

None of the “Top 100” mobile games that don’t already have a web storefront will implement one in 2025

This prediction is really an observation: Web storefronts have already achieved peak penetration. From which it follows that there won’t be a lot of new large-scale web storefronts coming on line in 2025.

To understand the observation: 2024 was the year that web storefronts got everyone’s attention. Perhaps most dramatically, Appcharge analyzed web store adoption rates in mobile games and discovered that 72 of the top 100 mobile games already had a web storefront. Appcharge also discovered that adoption varied widely by genre: 100% of social casinos had web storefronts, but only 30% of casual games had web storefronts.

The reasons for this variation in adoption are explained in detail in the Appcharge article cited above and in a related article by Jeff Gurian over at Mobile Game Doctor. But, in brief, they are:

The early and middle adopters have already adopted. 72% is already a high number.

Web storefronts aren’t free—they require implementation and maintenance and often require changes to game design.

To make the web storefront decision profitable, the game needs the players to make their purchases at the web storefront. The challenges involved in shifting purchase traffic can be significant.

In general, any game whose IAP revenue profile involves large numbers of players making small and infrequent impulse purchases will find it hard to move purchase traffic to a web storefront.

Given the compelling monetary incentives associated to web storefronts in general, we think that most of the top 100 games that don’t have a web storefront already have made a rational decision that web storefronts won’t work for them.

Web Storefronts Will Achieve Significant Revenue Growth by Adopting Experimentation and Personalization

But, still, 72% of the top 100 mobile games have a web storefront. As the game teams gain experience with their storefronts and add more functionality, the possibilities for personalization-driven revenue growth are enormous. The most significant revenue growth driver in mobile games in 2025 will be the widespread adoption of experimentation-based personalization regimes.

Eric Seufert made the case eloquently in a tweet and then a follow-up article on Mobile Dev Memo.

There is an interesting question, though—Eric has emphasized the value of experimentation and personalization since 2022, and GDP grew out of our experiences doing personalized pricing and bundling at Scientific Revenue from 2013 to 2019. Why aren’t all web stores personalized already? Why do we think this the primary avenue for revenue growth in 2025?

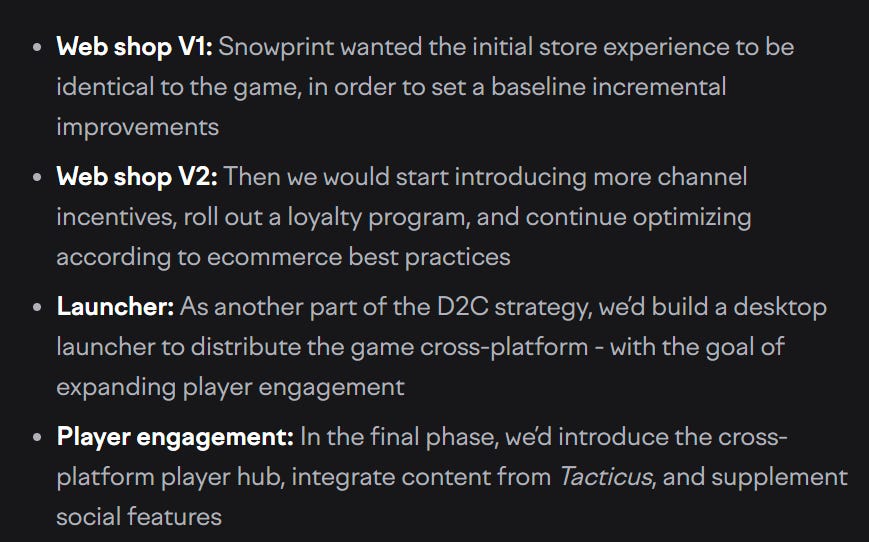

The answer is simple: first, you have to build the store. As Stash put it in their case study, these things have a lifecycle.

This can take years to execute.

AR/VR will finally gain significant traction, making revenue optimization an even more difficult problem

This is probably the first controversial prediction: AR/VR is on the verge of a breakthrough. It may not happen in 2025, but by the end of the year, everyone will agree that the momentum is real.

It’s easy to point to Apple’s spectacular failure with the Vision Pro and the fact that analysts slashed forecasts for the Meta Quest 3 as proof points for the opposite case. And, indeed, many industry luminaries are doing precisely that on LinkedIn.

But this ignores (or, at least, glosses over) the ongoing adoption trends:

Apple and Sony are now partnering, Google and Samsung have been partners since 2023, and Meta is staying the course. The hardware investment is increasing.

The slashed forecast for the Meta Quest 3 in 2024 is still at least 2.5 million units. That’s a lot of early adopters and cautious experimenters.

Meta’s smart glasses are the top-selling product in Rayban stores.

Even if you assume linear growth over the 2024 numbers, you’re looking at 15 to 20 million units sold. Admittedly, this is nothing compared to mobile phones, but it is roughly the number of PlayStation 5s that Sony sold in 2024 (and, given that we’re in the back end of the console lifecycle, more than Sony will sell in 2025).

It seems like a very bad bet to assume that amidst all those people, nothing compelling will emerge.

Of course, this is terrible news if you’re trying to build a global, long-term revenue optimization platform for gaming. Modeling the LTV impact of Console <-> Meta cross-play is the stuff of statistical nightmares..

Alternative App stores will be more than 10% of the Western mobile gaming market by install

2024 was the year of the webstore in mobile gaming. And a previous prediction was a about the rise of personalization in webstores. But there’s another equally compelling trend happening because of Epic. Epic’s almost-quixotic legal battles to open up distribution and on-deck purchases are being quietly resolved in Epic’s favor.

The resolution in Europe is happening via regulation. The European Union’s Digital Markets Act (DMA), which came into effect in 2024, introduces regulations to enhance competition and limit the dominance of major tech platforms, referred to as “gatekeepers” by the DMA. A key provision of the DMA requires these gatekeepers to permit the installation of alternative app stores on their devices, thereby reducing their control over app distribution.

In the US, the courts are starting to decide in favor of Epic. In October of 2024, judges ruled that Google’s Android app store was an illegal monopoly.

Consequently, alternative app stores are gradually emerging—first in Europe, but eventually everywhere. The Epic Appstore is already live in Europe, and the Microsoft Appstore is code-complete (Microsoft is just waiting for the appeals to be exhausted).

It remains to be seen how widespread adoption of these app stores will be, but Epic has also started having its app store preinstalled on Android devices and it seems a safe bet that they will get 10% of the market within a year.

It will become ordinary for games to sell physical goods and game-related merchandise in-game

Quietly, almost stealthily, Amazon released Amazon Anywhere in 2023. The idea is simple: it’s a way for developers to incorporate Amazon e-commerce from within their games or apps easily. That is, it’s a way for players to easily buy goods from Amazon without leaving the game.

The first use was with “Peridot,” an augmented reality game developed by Niantic in which players can buy Peridot-branded merchandise directly within the game.

Amazon explains it this way: “Developers and creators are able to broaden in-game or in-app environments to offer more than digital products, opening up a new way to engage their audiences without worrying about selection, shipping, or fulfillment. Instead, they can focus on creating incredible experiences.”

We see this as being related to the following trends:

There is an increasing industry focus on cross-platform strategies that leverage IP to create growth. At the recent GamesBeat Next in October, the growth conversation began with “Beloved IPs are Crossing between Games and Other Mediums”

Relatedly, many companies from other verticals are focusing on video games. While it would be incorrect to say companies like Mattel, Sands, and Hasbro are new to video games, they are now paying unprecedented attention to them.

Both of these trends mean that experimentation with “Play the game, buy the plushie” is inevitable. We don’t think this will become a common or standard practice in 2025, but we do think it will no longer be surprising when we see it.